Indiana families and individuals would pay a little less money to the state in taxes if a bill passed by the Indiana House of Representatives becomes law.

House Bill 1211, backed by Gov. Mike Pence and authored by Rep. Tim Brown, R- Crawfordsville, would require that several income tax exemptions be adjusted annually to adjust for inflation.

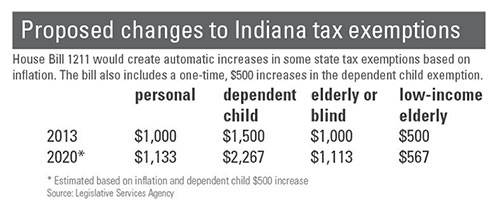

The legislation would also raise the dependent child exemption from $1,500 to $2,000 per child.

Under current law, tax exemptions have set value. The bill would now allow for income tax exemptions to be adjusted based on changes in the federal Consumer Price Index.

“Inflation has the insidious aspect of taking more and more of a family’s income,” Brown said.

If approved, the state would collect about $32 million less from income taxes in 2015 and an estimated $60 million less by 2020, according to a fiscal note from the nonpartisan Legislative Services Agency. Those amounts would be savings to Hoosiers.

The individual savings would depend on the exemption. The personal exemption would increase from $1,000 now to $1,018 next year and then to an estimated $1,133 by 2020.

The bill passed unanimously 96-0 and now moves to the Senate for further consideration.

Jacob Rund is a reporter for TheStatehouseFile.com, a news website powered by Franklin College Journalism Students.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.