Oirignally posted April 25, 2018. Updated: May 3, 2018

The first wave of 2018 school funding referenda are up for consideration Tuesday. That means voters in several counties will have the power to approve or deny tax measures to make millions of dollars available for their local schools.

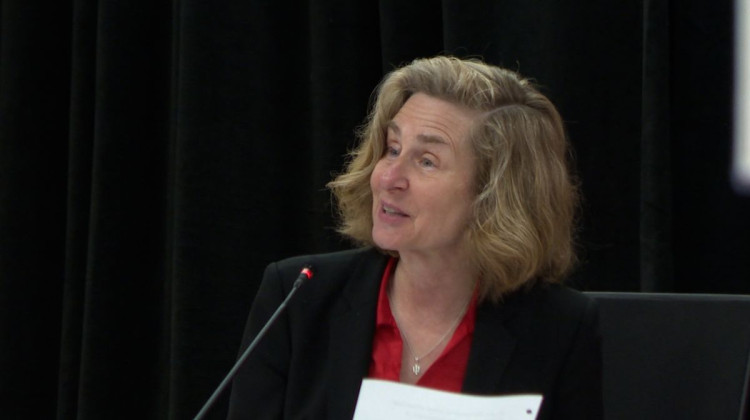

Purdue University economics professor Larry DeBoer says school funding referenda are usually more likely to pass in May, and the overall number of those winning voter approval has grown in recent years.

However, he also says schools asking voters to give them more money isn’t common statewide.

“It’s still the case that just a little bit more than one-third of school corporations have ever tried a referenda. So, most school corporations have never tried,” he says.

Central Indy Area Districts Seek Passage

Warren Township’s request is for $40 million, spread over the next eight years. This revenue could go toward school safety programs, transportation, and teacher recruitment.

Anderson Community Schools is seeking passage of two referenda - $41 million for construction and $1.8 million for operations.

Avon Community Schools’ is asking for an extra $9.5 million annually, for the next 8 years, to hire more teachers and reduce class sizes.

While the Avon Community Schools’ 2011 referendum failed by a large margin, statewide seventy percent of referenda on May ballots have passed Since 2009.

More Funding Measures Winning Votes

Goshen and Anderson Community Schools are each asking voters to approve a property tax increase for both construction projects and general school funding. DeBoer says if past trends are any indication, those districts will likely win both measures or nothing.

“When you propose two, they either both pass or they both fail. It has never been the case that one has passed and one has failed,” he says.

Data from previous years show construction measures fail slightly more often than general school funding levies. But DeBoer says voter approval for school funding measures has increased in recent years, and they’re more likely to pass in spring elections compared to the fall.

There’s also a funding referendum unlike the rest included in this year’s set of spring measures. Hancock County is proposing a $55 million construction bond for jail renovation and construction. DeBoer says, that’s somewhat unusual.

“We haven’t seen very many non-school referenda – although counties, cities, and towns are subject to the same rules as Indiana schools are, as far as capital projects are concerned,” he says.

A total of 11 different school funding measures will be considered on election day, mostly by voters from counties in the northern half of the state; those include Madison, Elkhart, Allen, Lake, Marion, and Hendricks counties. After election day, Indiana voters will have seen 175 school funding referenda since 2008.

Below, you can see key details about the school measures up for consideration May 8th.

Construction Projects

Alexandria Community School Corporation, Madison County

Property tax rate: $.50 per $100 assessed value

For: Renovation/construction at Alexandria-Monroe Intermediate, Jr./Sr. High

Anderson Community School Corporation, Madison County

Property tax rate: $.2055 per $100 of assessed value

For: Improvements, renovation, construction at several schools

Goshen Community Schools, Elkhart County

Property tax rate: $.3790 per $100 of assessed value

For: Goshen High/Middle Schools, new intermediate grade level building, and safety/security improvements at others

North West Allen County School Corporation, Allen County

Property tax rate: $.1275 per $100 of assessed value

For: Buying new property, building a new elementary school, technology and site improvements for existing schools

General School Levy

Anderson Community School Corporation, Madison County

Property tax rate: $.1077 per $100 of assessed value

For: teacher retention and pay, class size, funding academic and support programs

Avon Community School Corporation, Hendricks County

Property tax rate: $.3536 per $100 of assessed value

For: reducing class size, funding and retention of teachers, more instructional support

Crown Point Community School Corporation, Lake County

Property tax rate: $.21 per $100 of assessed value (continued tax)

For: manage class size, teacher retention

Goshen Community Schools, Elkhart County

Property tax rate: $.26 per $100 of assessed value

For: manage class size, teacher retention

Lake Central School Corporation, Lake County

Property tax rate: $.17 per $100 of assessed value

For: manage class size, teacher retention

MSD of Warren Township, Marion County

Property tax rate: $.21 per $100 of assessed value

For: Transportation, teacher retention programs, professional development, tech programs, safety and security

Smith-Green Community School Corporation

Property tax rate: $.628 per $100 of assessed value

For: Student safety, transportation

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.