The state of Indiana filed a lawsuit Monday to allow it to collect sales tax from online sellers who don’t have a presence in Indiana. New state legislation that prompted the lawsuit means the state could collect those taxes if the courts rule in its favor. The U.S. Supreme Court ruled in 1992 that online retailers don’t have to collect and remit sales tax if they have no physical connection to the state. 2017 Indiana legislation directs the state to collect sales tax from online retailers w

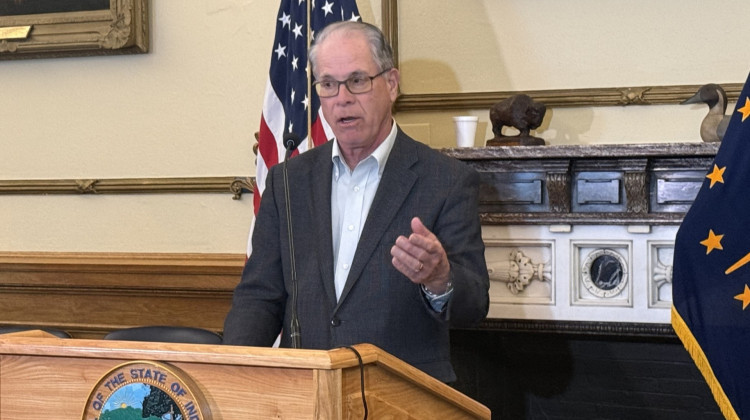

IPBS-RJCThe state of Indiana filed a lawsuit Monday to allow it to collect sales tax from online sellers who don’t have a presence in Indiana.

New state legislation that prompted the lawsuit means the state could collect those taxes if the courts rule in its favor.

The U.S. Supreme Court ruled in 1992 that online retailers don’t have to collect and remit sales tax if they have no physical connection to the state.

Indiana legislation signed in 2017 directs the state to collect sales tax from online retailers who either sell at least $100,000 worth of a goods in Indiana per year or make at least 200 Indiana-based transactions per year. But the legislation acknowledges legal action is first required – and Attorney General Curtis Hill took the first step Monday.

In a statement, Gov. Eric Holcomb says the Supreme Court needs to overturn its earlier opinion. Holcomb says the current landscape creates a disadvantage for Hoosier-based businesses.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.