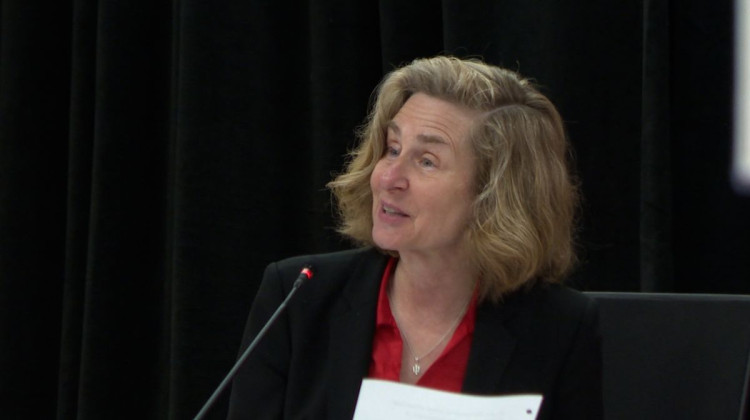

Indianapolis Public Schools Board President Evan Hawkins and Superintendent Aleesia Johnson listen during a board meeting presentation Nov. 17, 2022 at the district office. Hawkins’ term as a board member ends Dec. 31, 2022.

Eric Weddle/WFYIAfter a month of debate and community opposition, the Indianapolis Public Schools board delayed a vote planned for Thursday to place a $413.6 million property-tax referendum on the May 2023 primary ballot.

IPS Superintendent Aleesia Johnson and school board members offered no public comment during the meeting or took questions from the media afterward to explain the setback.

Leaders of nearly 30 charter schools have been critical of the proposal and said their students would face a widening racial and socioeconomic equity gap if the referendum went forward. Advocacy groups and some community members told the board they won’t support the levy if funds aren’t equitably shared with charter schools within the district boundary.

Earlier this month, Johnson said the district would not share referendum funds with indepdendent charter schools.

It’s uncertain when the IPS board will discuss the referendum again and if they will decide to share funds with charter schools who do not already partner with the district. School corporations must certify a referendum ballot question 74 days before a primary election, according to state law. The IPS board has until Feb. 17 to vote on the language to meet the deadline for the May 2 primary ballot.

"The specifics of the operating referendum are still under consideration as we continue conversations with our partners," IPS spokesperson Marc Ransord said in a statement Tuesday night after the board did not review the referendum plan during a public meeting. "We remain committed to delivering on our Rebuilding Stronger plan and earning our community’s support."

If the board does not hold a special meeting before the end of the month to address the referendum, it will be taken up by a much different group of commissioners next year.

The term for board members Evan Hawkins, Susan Collins and Taria Slack ends Dec. 31. The three did not seek re-election. Nicole Carey, Hope Hampton and Angelia Moore — winners of the November election — will join the seven-member board in January.

The IPS board was expected to vote on a resolution Thursday as part of the process to get the operating tax request on the spring ballot. If approved, the referendum would generate $413.6 million over eight years, or $51.7 million annually, according to district documents. This would replace the current operating referendum approved by voters in 2018.

Most of the proposed new funds would go toward teacher salaries, and the rest to academic program expansion as part of the district’s academic overhaul and additional funding for charter schools who operate in partnership with the district.

'Crucial dialogue' expected

Education advocates have asked the district to equitably allocate per-student funding from the operating referendum to charter schools who partner with the district and those who do not.

Students, parents and school leaders say the revenue is needed to provide more academic support to students and decrease the funding gap between traditional IPS schools and charter schools.

A coalition of city charter school leaders said the gap would increase by around $2,300 for independent charter schools if the referendum was passed as proposed.

Charter schools are not eligible to receive property-tax funds or referendum funds. But a public school district can agree to share referendum revenue with charter schools.

“I refuse to let anyone take away or underfunded schools that are making real impacts,” said Kiram Hansen, a sophomore at charter high school BELIEVE Circle City. “I ask you again, am I not a student? Are my friends not students? We all deserve to have equal funding as public students.”

But some community members do not want the district to share those funds.

Parent Michelle Pleasant, in a comment submitted to the board, said referendum funds are needed to support proposed academic changes for district controlled schools.

"Splitting those funds outside of our schools without oversight or control is irresponsible," Pleasant said.

Last year, IPS agreed to share roughly $27.5 million of its remaining 2018 operation referendum funds with 25 innovation charter schools that partner with the district. Now those schools receive $500 per in-district resident student. In comparison, students enrolled in district-managed schools receive $1,800 in funding.

So far, during public school board meetings, no one has spoken in favor of the proposed referendum. And the community’s opinion is essential if the district wants voters’ support. In the November midterm election, four of the eight Indiana school districts with property-tax levies failed to win voter approval.

Thursday local advocacy groups praised the board’s decision to delay the vote. Stand for Children Indiana’s executive director Justin Ohlemiller said he was hopeful changes could be made that earn the support of the group.

"The dialogue over the next few weeks will be crucial,” he said in a statement.

Last week, IPS board members voted to place a $410 million capital referendum on the May ballot. The funds will pay for a new $34.6 million facility for Joyce Kilmer School 69 and improvements at roughly 20 other schools. If approved, it would add $3.18 per month in property taxes to homeowners of a median-valued property.

Basics of the $413.6 million operating property tax levy:

If the levy is approved as originally proposed, the local property tax levy for the operating referendum would switch from $0.19 to no more than $0.25 per $100 of assessed value on Jan. 1, 2024. It would generate $51.7 million annually and add $2.60 per month in property taxes to homeowners of a median-valued property.

Indiana property taxes are capped at assessed value rates based on the type of property: 1 percent for owner-occupied homes; 2 percent for other residential properties and farmland; and 3 percent for all other property. But if voters approve a local referendum, a property tax bill can exceed the cap and the extra taxes go to the local school district.

Contact WFYI education reporter Elizabeth Gabriel at egabriel@wfyi.org. Follow on Twitter: @_elizabethgabs.

DONATE

DONATE

Support WFYI. We can't do it without you.

Support WFYI. We can't do it without you.